As you’ll know if you’ve read our past work, we take a pretty analytical approach when exploring opportunities within vertical software. We believe it’s only possible to have a thesis about the trajectory of a market if you understand it deeply. So, this time we’re looking at life sciences – specifically the biopharma industry – and evaluating opportunities for vertical software/AI across the value chain. This is just the first in a series of posts on this topic.

Market overview

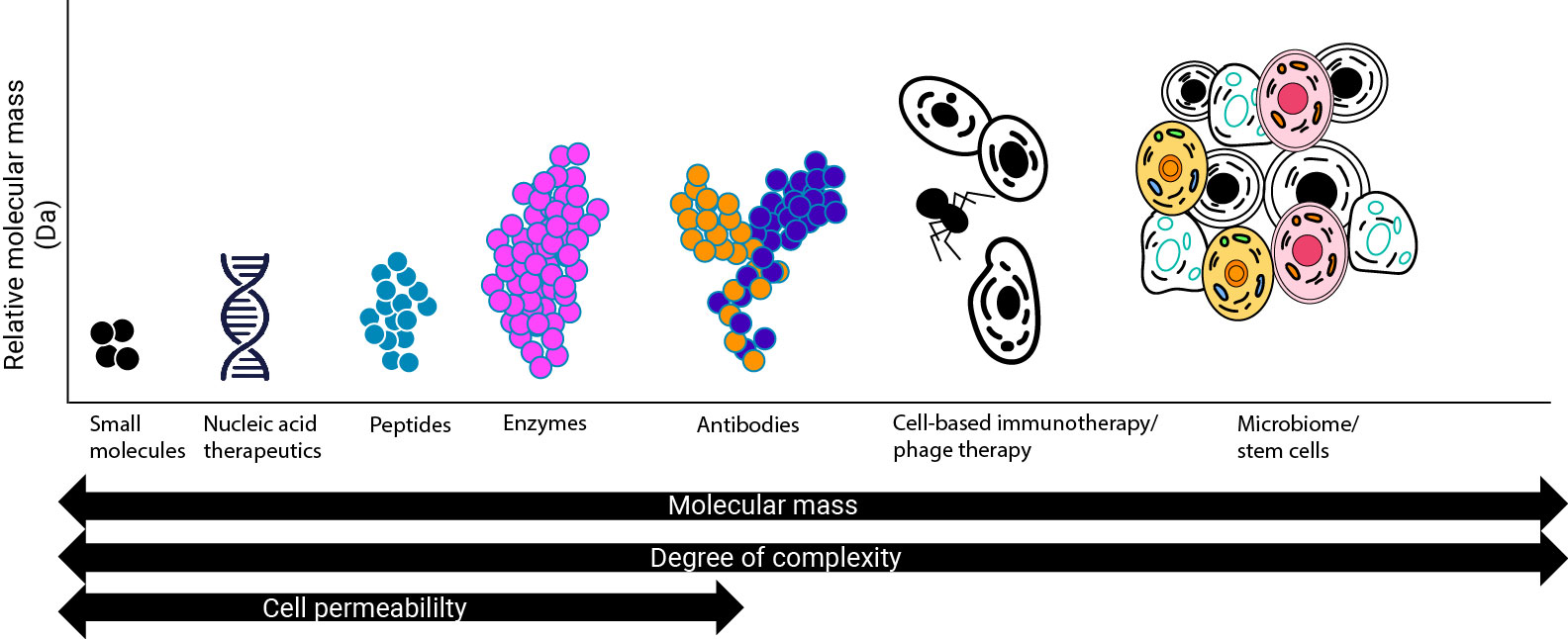

Historically, the distinction between a “biotech” vs. a “pharma” company was scientific in nature: it depended on the type of assets they were developing. “Biotech” referred to companies developing biologic products, or those derived from living organisms, and “pharma” referred to companies developing small molecule products, which are derived from chemical inputs.

But that distinction has changed over time. Today, most folks in the industry use “biotech” to refer to small and emerging companies that are really focused on early R&D, and “pharma” to talk about larger companies that are more focused on marketing commercial assets. To avoid confusion, I’m going to refer to all companies involved in the research, discovery, and development of therapeutic drugs as “biopharma,” while keeping in mind that companies of different sizes/maturities are going to operate very differently.

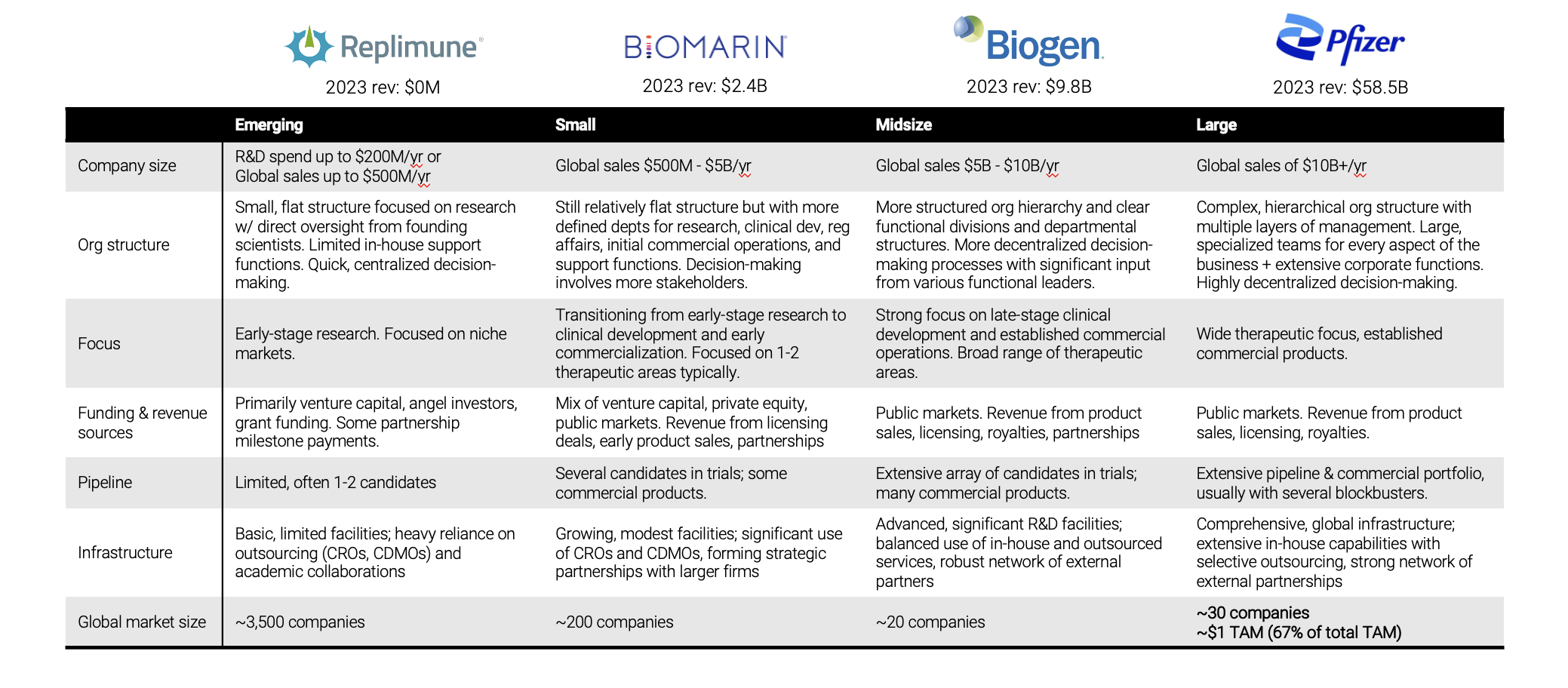

Here are examples of companies that would fall into each bucket (emerging, small, mid-size, and large biopharma):

The emerging segment covers pre-revenue to $500m in revenue per year – these are companies that are small and flat in structure. They’re really focused on early-stage research of 1 or maybe 2 assets. Usually, the founders are scientists themselves who are directly involved in the day-to-day. Because of that flat structure, they have quick, centralized decision making. But they’re resource constrained – they rely on VCs, angel investors, and grants for funding. And because of those resource constraints, they typically have very limited infrastructure. There are tons of these companies (by our estimate, more than 3,500 of them!).

The next group of small biopharma companies are generating anywhere from $500m to $5B in revenue per year. Their focus is transitioning from early-stage research to clinical development and early commercialization. They could be funded by a mix of VC, PE, and public markets. These companies have more defined departments, which means more stakeholders become involved in decision-making. They have a growing base of wholly owned facilities but they're still leaning on outsourced providers for some work. By our estimate, there are a couple hundred companies in this category.

Companies in the midsize segment are more structured and hierarchical. There's more decentralized decision making, and the complexity and breadth of the owned infrastructure is increasing. They're focused on later stage development and commercial products across a broad range of therapeutic areas. These companies are mostly public market funded. There are about 20 biopharma companies globally in this category.

The largest biopharma companies are doing more than $10B in revenue per year. These are very large organizations. Pfizer, for example, is generating $60B/year and it’s not even the largest in the world. Companies in this segment have an even more complex hierarchical structure with heavily decentralized decision making, which usually happens at the business unit level. There are lots of layers of management. They have a wide therapeutic focus, with an extensive pipeline and portfolio of commercial products, often with several blockbuster drugs. There are about 30 companies in this category, and they make up ~$1T in total TAM (that's two-thirds of the total market TAM!) which just goes to show how heavily concentrated market share is in the industry.

The role of generative AI

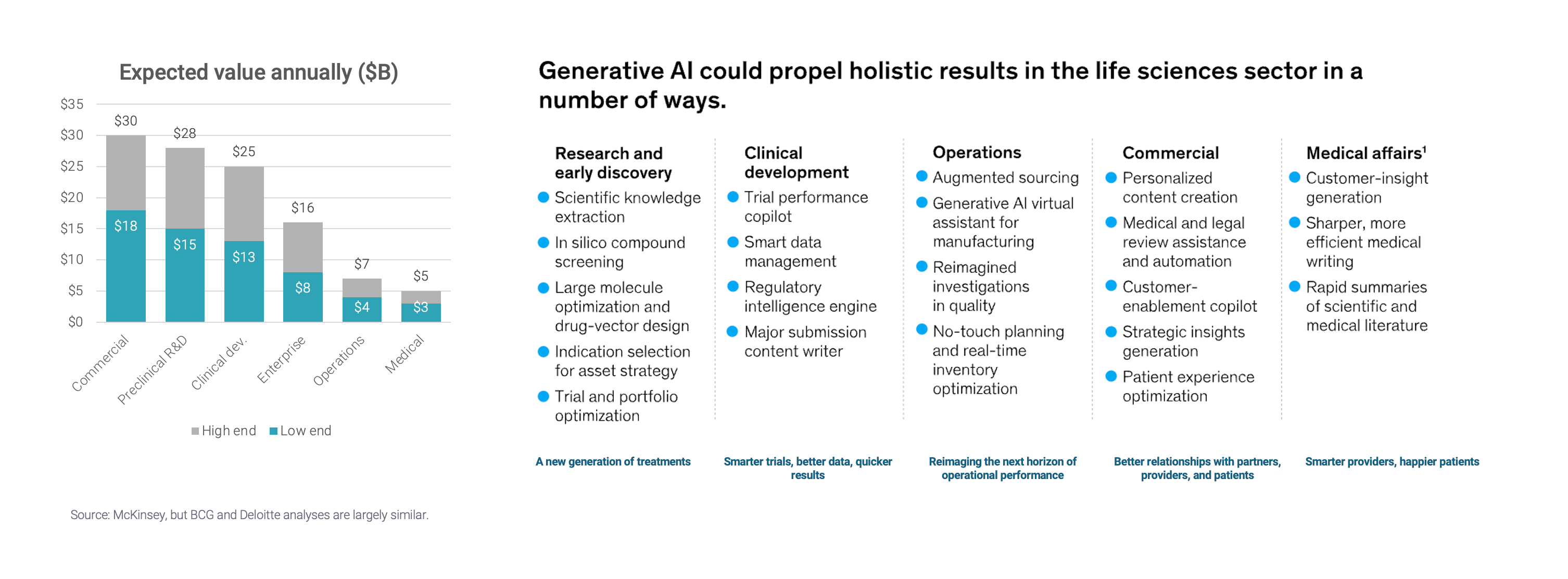

The consensus among consulting firms is that AI should produce sizeable value across the biopharma value chain (McKinsey, Deloitte, BCG) – to the tune of $60-110B, according to McKinsey. Most of that value is expected to come from R&D.

Source: McKinsey

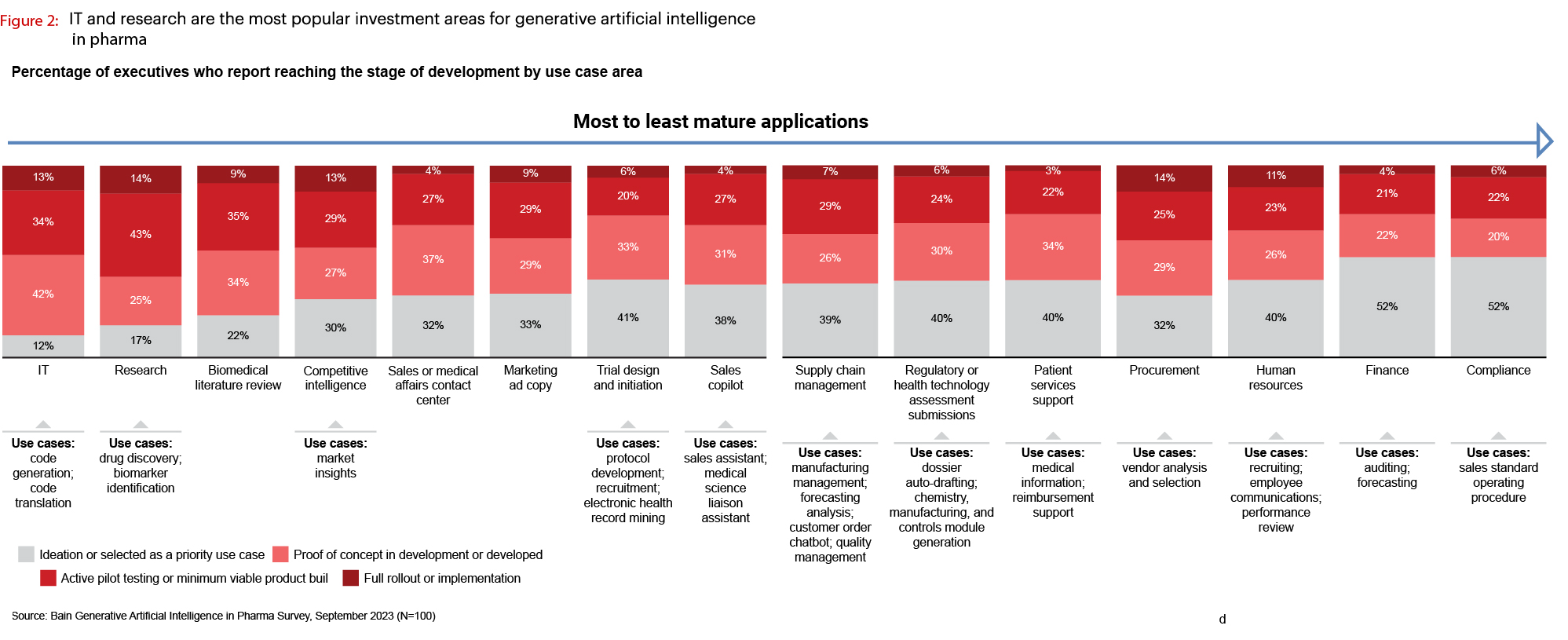

When you dive a little deeper into what is being implemented, research shows that across the board the degree of full rollout or implementation is relatively low (at the max it's 14%). And most of the activity is in proof of concept or pilot testing. The industry is in very early innings of adoption.

Source: Bain

As I talk to folks in the industry, I consistently hear that there are three things that need to happen before this AI hype can become a reality:

Enterprise-wide IT infrastructure: According to BCG, only 55% of pharma companies report having the data maturity and expertise needed to build a meaningful GenAI capability in the short term. They need enterprise-wide infrastructure and platforms that give people access to the tools and give the tools access to data.

Centralization: 34% of the time it’s business teams who are setting the AI agenda, 30% of the time it is enterprise IT and 26% of the time it is both (ZS Associates). As early wins breed interest and energy across the org, it’s increasingly critical for executives to shift from disconnected pockets of gen AI experimentation to an enterprise-wide program, coordinated through a central team.

Change management: According to BCG, 70% of the value from GenAI is determined by how well a company manages change. Most will need a hands-on change management program.

Today, a lot of the AI activity is at the business level, but most agree that for the power of AI to be truly unlocked, it needs to move away from isolated experimental efforts to a company-wide initiative managed by a central team. And that will take a major effort in change management.

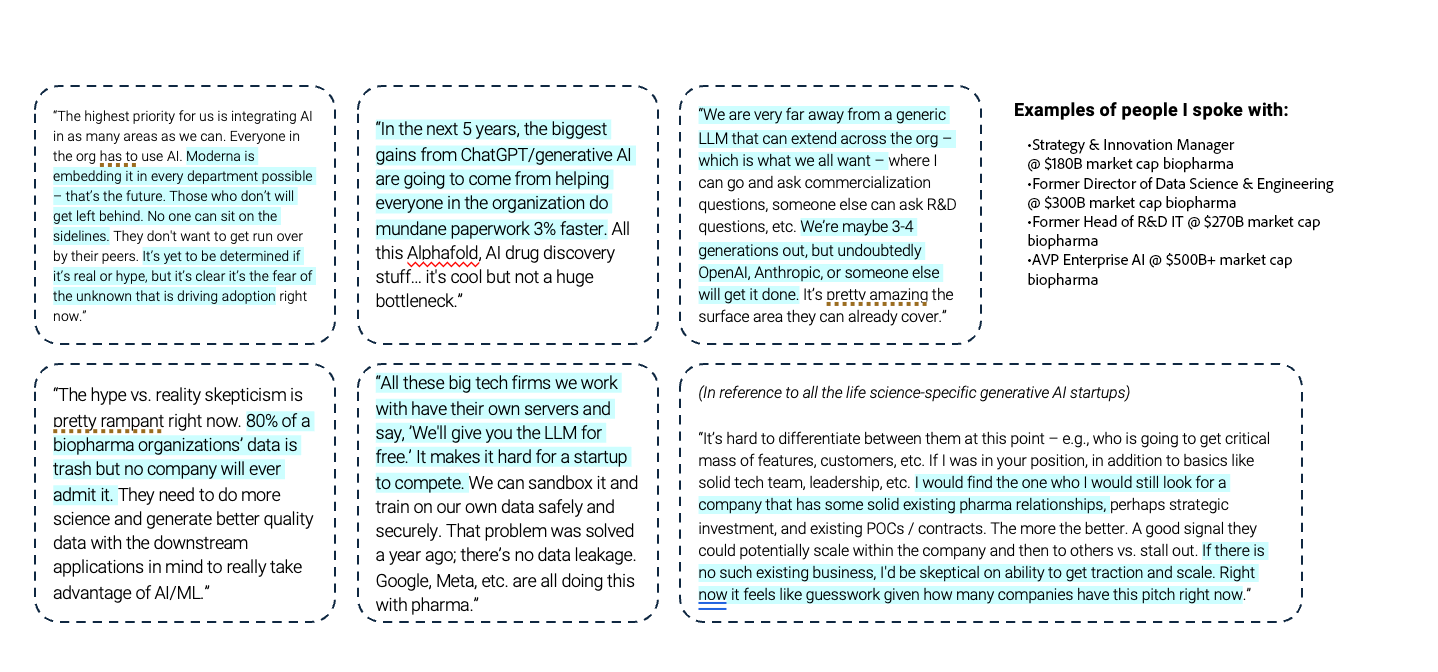

Based on my conversations with industry experts, the north star everyone is waiting for is an LLM that can equally meet the needs of horizontal, industry-agnostic use cases and life science-specific workflows across all departments within a biopharma organization. Few believe it will be achieved in the short term, but on the flip side, most believe that the existing large-scale LLM developers will be the ones responsible for bringing it to fruition (vs. more emerging life science-specific AI startups). Here’s the sentiment I consistently hear:

So, it is clear that there are varied opportunities for AI to make a significant impact across the biopharma value chain. In the next two posts we will take a deeper look at what needs to happen to turn the hype into reality.