In our last post, we discussed some of the key overarching trends and changing industry dynamics across biopharma R&D, including (but not limited to) declining R&D productivity and increasing fragmentation across the R&D value chain. Today, we evaluate where there might be (or might not be) opportunities for tech to address some of these challenges.

What can be done to improve R&D productivity?

There are two aspects to R&D productivity: efficiency and effectiveness.

The effectiveness part refers to the value per new drug approved, so it's a largely a function of the volume that can be transacted in the market and also the unit price. But as I mentioned in the previous post with examples like the IRA, there are a lot of externalities and things outside of the biopharma company’s control that are going to impact their ability to boost that effectiveness factor.

What’s more in their control is the efficiency side. This refers to reducing the cost and time that it takes to get from input to output. Improving success rates along the way (i.e., moving from one stage of the R&D lifecycle to the next stage) is a major function of that. So optimizing success rates and reducing costs in R&D is the largest opportunity for biopharma companies to make a positive impact on R&D productivity.

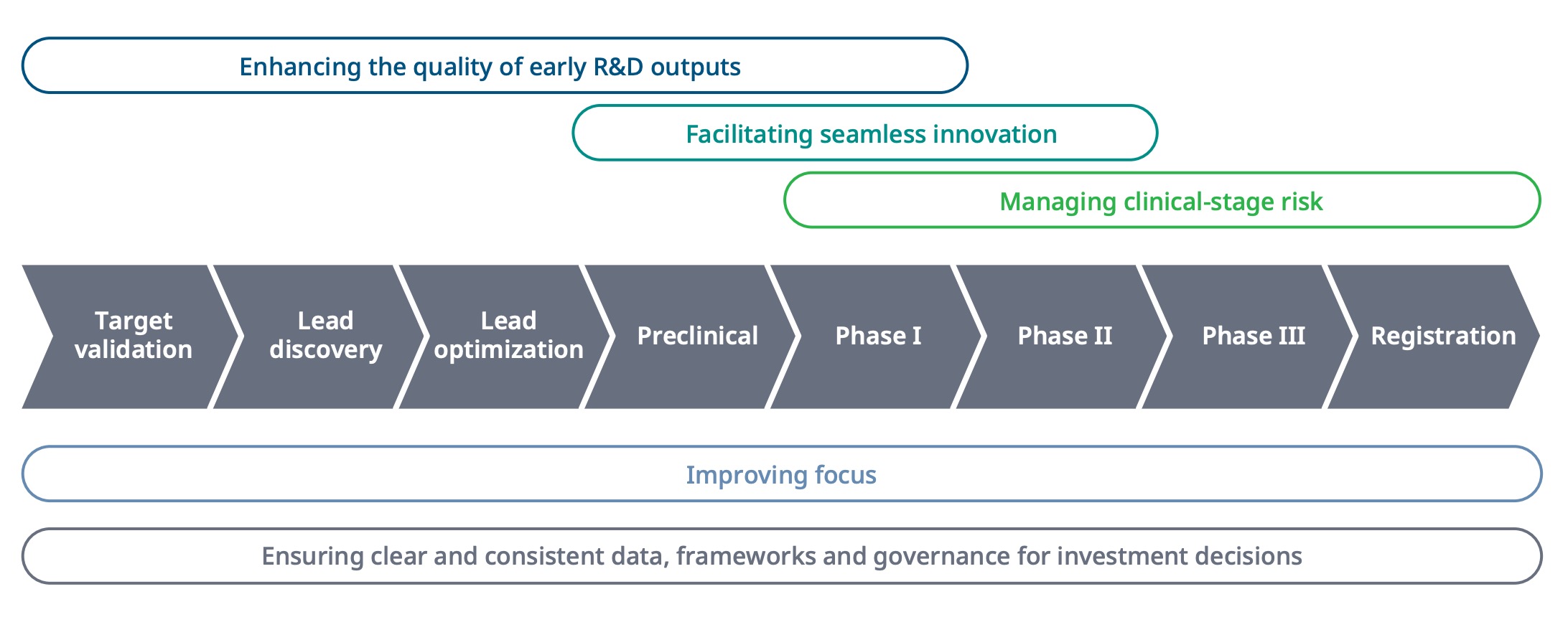

There are several opportunities across life cycle to improve success rates. In the earlier days, it's really about enhancing the quality of the early R&D outputs and then later in life cycle it's more about facilitating general operational efficiencies and managing clinical stage risk. In the clinical trial phase, it's no longer about identifying the right drug and optimizing it and is much more about managing all those other factors that could lead to clinical trial failure.

Source: IQVIA

Early-stage R&D

Most of the excitement around tech in early-stage R&D has focused on AI to improve success rates in target validation, lead discovery, and lead optimization. As we discussed in our first post, the opportunity here, in theory, is massive. But unfortunately, the business models supporting this vision are typically out of scope for what we look for at OMERS Ventures. At OV, our expertise is in software, not bioscience. And based on our research, most AI drug discovery companies end up becoming biopharma companies themselves. Why? We’ve distilled it down to eight key factors:

1. Value capture: Advancing their own drug candidates allows AI companies to capture a larger portion of the value chain.

2. Proof of concept: Demonstrating the efficacy of their AI through successful drug candidates can be a powerful POC and the foundation for more material partnerships/commercial arrangements.

3. Control over development: By advancing their own candidates, they maintain control over the development process. This can be crucial for ensuring their AI insights are implemented correctly.

4. Differentiation: Many AI platforms claim to improve drug discovery, but those that can show tangible results stand out. *As an aside, no AI-discovered/designed drugs have been approved yet, but several are in clinical trials.

5. Financial incentives: While selling software/services might provide steady revenue, the potential profits from a successful drug can be exponentially higher.

6. Exit potential: Biopharmas might be more interested in acquiring AI drug discovery companies w/ promising pipelines vs. just a software tool.

7. Adoption & integration challenges: Selling software to biopharma discovery teams involves navigating complex regulatory landscapes and integrating with existing systems. These hurdles can slow down the adoption and limit the immediate impact of the AI.

8. IP & data ownership: Owning the IP and data associated with drug candidates can be more advantageous than just providing sw. These assets that can be leveraged in various ways, including licensing, partnerships, or direct commercialization.

There might be other opportunities for software purpose-built for preclinical R&D – for example, there are a lot of bioinformatics solutions on the market – but we see several challenges that can limit adoption and long-term defensibility of these pick and shovel tools. Some of the most common challenges we’ve uncovered (in very simplified terms) are as follows:

Size of the market: Keep in mind that we’re generally looking for companies that can grow to hundreds of millions in revenue in a 7-10 year timeframe. The market needs to be big and ripe enough to support that. Now, a quick reminder: most of the industry’s preclinical R&D work resides within smaller biopharma companies. So when we’re talking about software targeting preclinical work, the smaller/less mature biopharma organizations represent the largest ICP segment. Second – and this is specific to bioinformatics tooling – there's a talent gap that leads to a demand gap vs. expectations. Though a lot of folks like to talk about how every emerging/small biotech is leveraging computational science, there really aren't as many of these potential users as people think, so it's a pretty constrained market today (though, to be fair, it is growing). Third, the budget for software also very limited. Most of the software budget in preclinical R&D typically goes to the electronic lab notebook (e.g., Benchling), and there are very limited resources on top of that to allocate to much else. To allocate additional resources, the software solution needs to have a very strong value proposition and ROI in terms of the scientific output (vs. shaving off a few hours or improving employee experience etc.).

Selling to scientists: Scientists are very particular, with strong preferences and habitual ways of doing things. The vendors targeting them need to have extreme domain expertise and an ability to translate very specific and technical needs into a likeable – and more importantly flexible – product.

Commoditization risk: Based on what we’ve seen so far, it seems hard for vendors in this space to build differentiated products with durable, technical moats. Many of the data pipelines that scientists use (and prefer) are open-sourced. Dynamic compute scaling isn’t necessarily unique – it’s something that data scientists/engineers with the appropriate training can configure directly in AWS. It’s more of a convenience feature. So the main differences we’ve seen in products here are more or less philosophical differences in design. But the challenge with that, again, is that what’s deemed “good, better, or best” is often judged by individual scientists. Which means if you take a stance on a certain design, you’re alienating other parts of the (already limited) market.

GTM efficiency: If there’s little room for technical differentiation, success will depend on having the most efficient and effective GTM. We already discussed the fact that scientists (as core users) are difficult to repeatably, scalably build an engagement and product development model around. But there’s another layer to this: when it comes to preclinical software, there's unclear ownership about who owns this budget and decision-making authority. For some companies, it's the Chief Science Officer, and for others it’s the CTO/Head of IT. But these people have very different priorities and philosophies when it comes to software, so the GTM has to be radically different depending on who they’re selling to.

And then the last point to consider here is that scientists and R&D organizations in general are extremely protective of their scientific data. Especially for pre-commercial biopharma companies, their scientific data is their core IP. So it takes a lot for them to get comfortable with a vendor that's going to be managing that data. In other industries, software vendors generally don’t have to worry about meeting strict security and compliance requirements (that’s reserved for larger, enterprise-scale accounts), but that’s not the case in biopharma.

To be clear: we’re not counting out all software selling into preclinical R&D, but we are hyper conscious of the challenges outlined above. If anyone has had repeated success overcoming these barriers, we would love to hear from you.

Clinical-stage R&D

Where we see more outsized opportunities is in clinical stage R&D. As a reminder, clinical-stage R&D refers to the stages after the company has identified the drug, optimized it, determined that it works and is safe in animals, and now needs to test it in humans. As mentioned previously, this is by far one of the largest spend areas for biopharma and it takes a tremendous amount of time and comes with very high failure rates. Importantly, many of the reasons why trials fail at this point are irrespective of the actual science. Things that technology could help fix.

So it comes as no surprise that this area is very heavily funded by venture capital. Billions have been invested in the clinical trial tech space (hundreds of companies) since 2015. Two of the most heavily invested and competitive areas are decentralized clinical trials (DCTs) and participant recruitment. But there are still untapped opportunities in other areas.

Recall, the two things biopharma sponsors care most about in the clinical stage are: success rates (successfully completing 1 trial phase and moving on to the next) and timeline (longer trial timelines = higher trial costs and longer time to get the drug to market). There are several key levers that can impact trial success and timelines. Outside of participant recruitment and enrollment, other levers include: protocol design, site selection, site management, participant experience, and more generally data and document management practices.

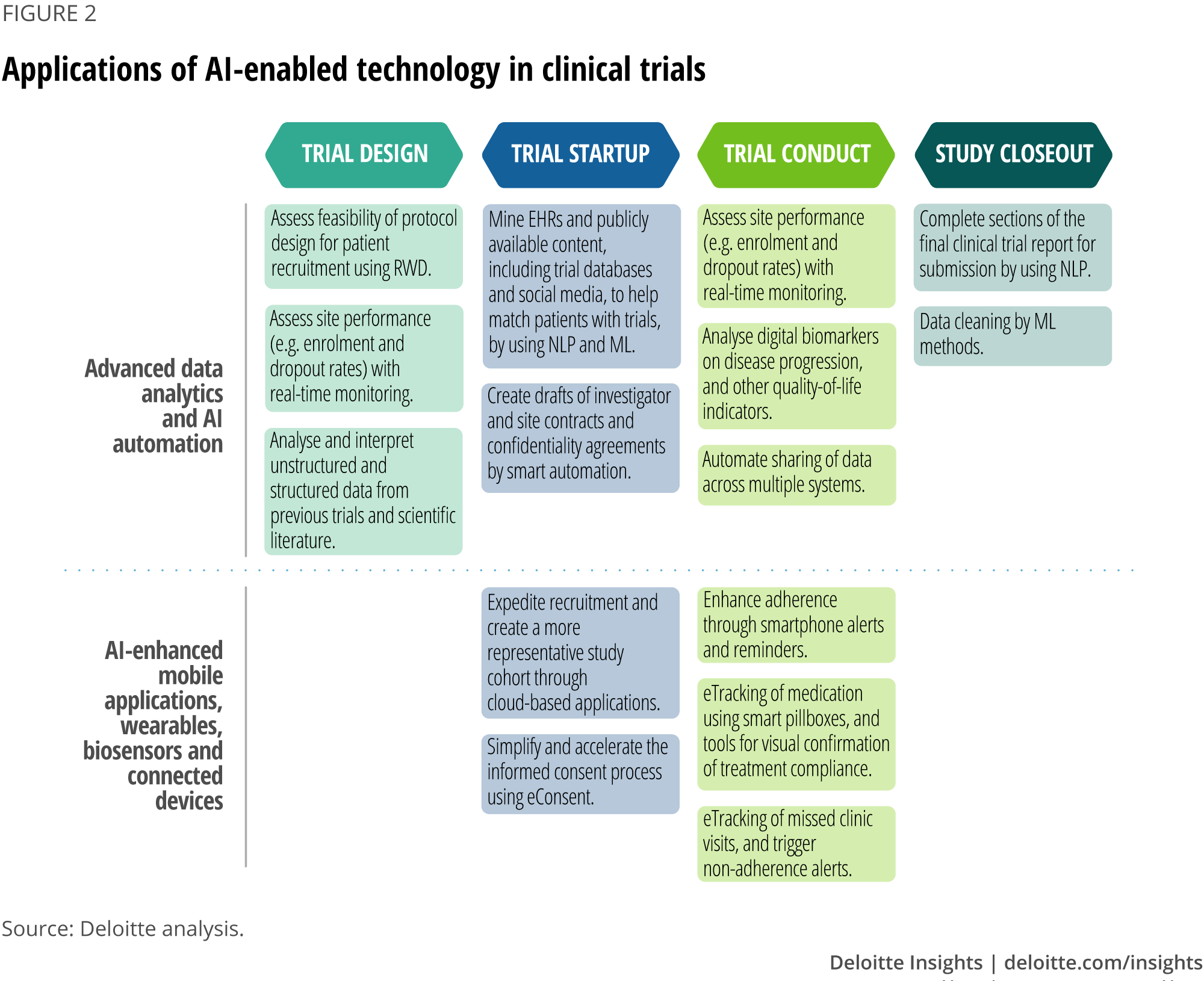

I’m particularly interested in the application of AI to some of these levers, particularly as it relates to data analytics and automation. I see several opportunities at each stage of the study lifecycle, from trial design to study closeout.

Source: Deloitte

Why am I most excited about advanced data analytics and AI automation? Because I think this is where there’s the greatest opportunity for a software vendor to build truly differentiating capabilities. What do I mean by differentiating capabilities? In general, I see three types of capabilities when it comes to clinical trial software:

1. License to operate: These are the capabilities that trial stakeholders need to operate; the table stakes stuff. These are largely being offered by system of record incumbents and because the capabilities aren’t providing much by way of success rate improvement, timeline acceleration, or cost reduction (vs industry norms), these solutions are pretty commoditized with little to no pricing leverage.

2. Industry standard capabilities might reduce risk of trial failure or accelerate timelines modestly (~10% or so). But the underlying reason why is typically due to broad workflow improvements on top of an existing “license to operate” system. And because of that, most of that value can be captured by those incumbents.

3. Differentiating capabilities are really the ones that allow the customer to lead the industry. These differentiated capabilities usually come about by leveraging a combination of the customer’s existing data and existing systems in a novel way and/or bringing various stakeholders together into one platform, creating a new standard of collaboration. By doing that, they can accelerate their trials to a greater extent (perhaps on the order of 20 to 30% or more) or potentially even turn a trial that otherwise would have failed into a successful one. So this is where there’s the strongest value proposition (and associated ROI) for software/AI. Innovation here is more likely to come from startups (vs. incumbents) because it’ll require a new entrant to stitch it all together on a modern tech stack. Some example areas where differentiating capabilities might surface include protocol complexity optimization, trial simulations, and AI-generated medical writing.

Does this sound like you?

If you’ve come this far and finished the series, the chances are you work or are deeply embedded in this space. If you are creating solutions to tackle the huge challenges outlined above, I’d love to hear from you. And even if you’re not building in the space, but you want to challenge me on some of my thinking, I’m all ears. Feel free to reach out to me at mmoore@omersventures.com.