In a previous post, we outlined (at a very high level) the different segments of the biopharma industry, where the opportunities for AI could lie across the value chain, and what needs to happen to turn that hype into reality. In this post, we begin our deep dive into the R&D side of the house, looking first at some of the overarching macro trends that are making R&D more difficult than ever before. Some have argued these pressures are driving greater demand for software/AI solutions that can improve efficiency and drive cost savings. In theory, we agree, but there are also budgetary and behavioral aspects that can challenge adoption in certain areas. In other areas, we do see real opportunities to build venture-scale software businesses, and the time is ripe for new entrants to seize those opportunities. We’ll get into these specific applications in a future post, but first, here’s a quick overview of the R&D lifecycle and some of the overarching macro trends impacting it.

The R&D lifecycle:

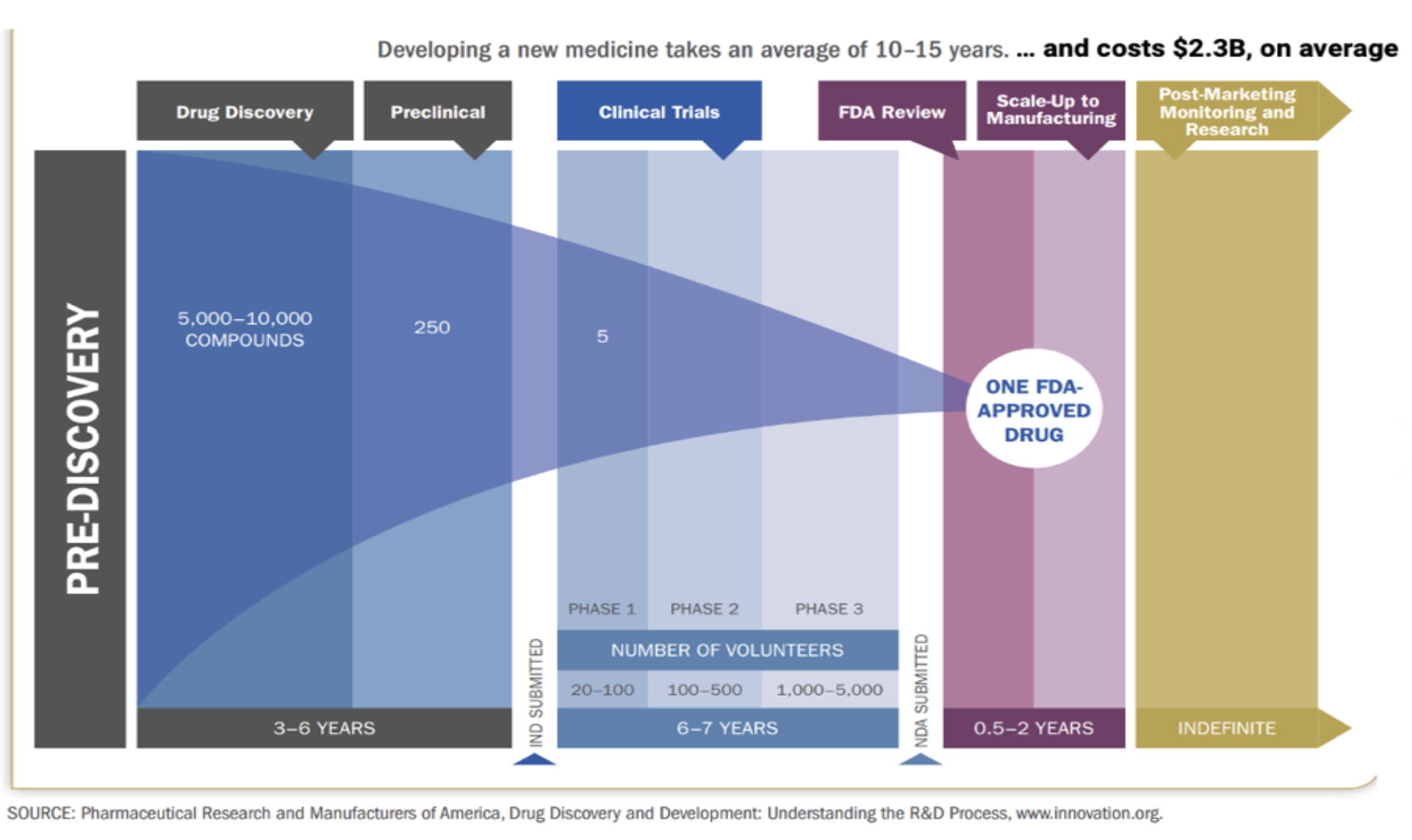

This is what the drug R&D life cycle looks like from very early-stage pre-discovery to commercialization and even post-commercialization. The point here is that it takes an incredible amount of time, money, and effort to bring a single drug to market. It’s characterized by high failure rates at every stage of the process. We're talking about going from 10,000 compounds in the discovery phase to just one FDA approved drug 15 years later. The other important thing to note here is that it's a very stage-gated process right, so you can't move on to the next phase until you've completed the preceding phase. And some of those “gates” are controlled by the regulators.

Macro R&D trends:

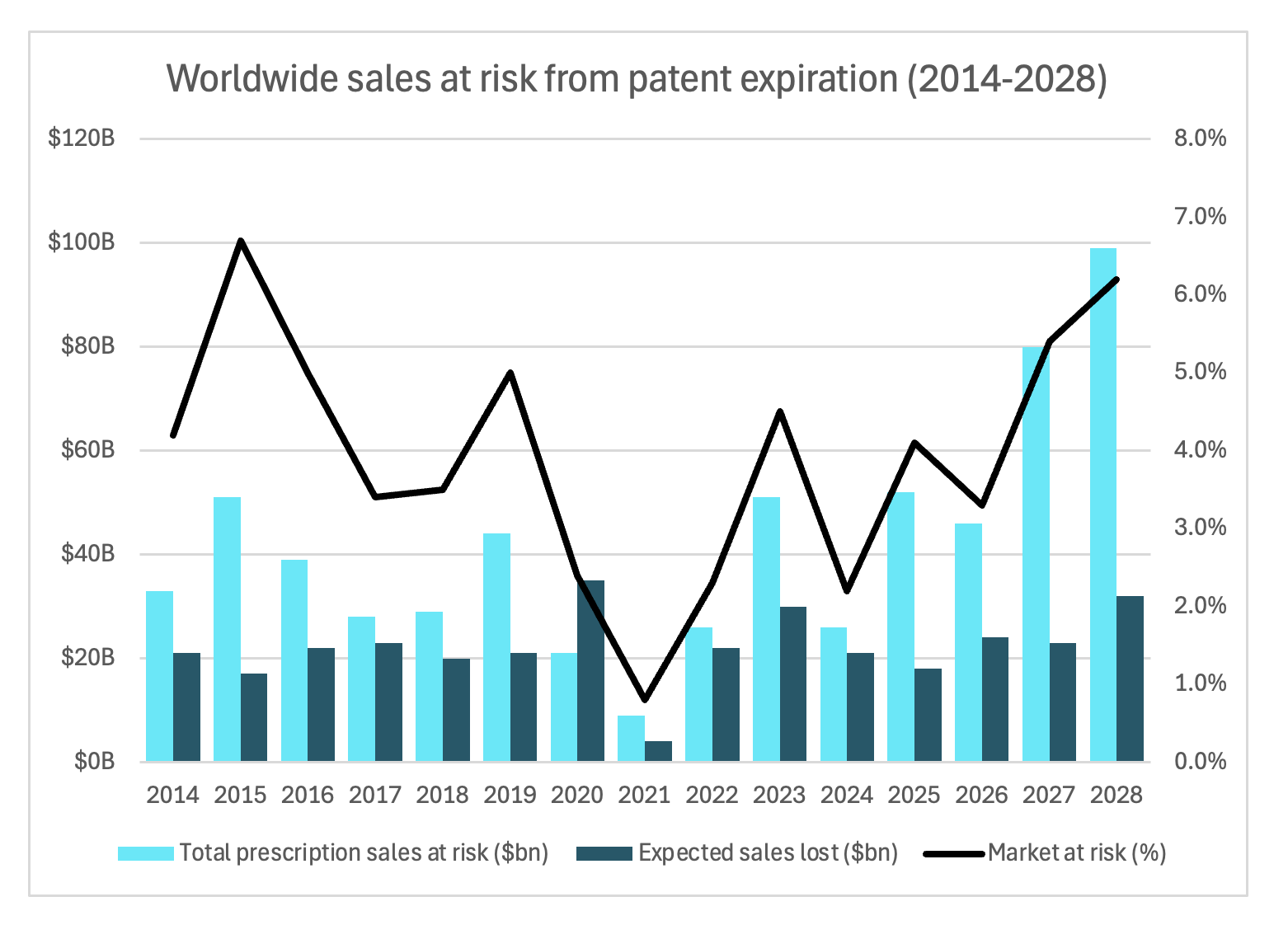

There are a bunch of macro-level trends that are making R&D all that much harder right now than has ever been the case historically. One thing that is very top of mind for companies with brand name drugs coming off exclusivity is this idea of a patent cliff. When their drugs lose exclusivity, it means generic versions of the drug can be manufactured and marketed at significantly lower prices, and when that happens, market share is redistributed from that one brand-name developer to potentially several generic developers. And right now, we’re actually on the precipice of one of the biggest patents cliffs in recent history, because many of the largest blockbuster drugs on the market are all coming off exclusivity around the same time. By 2028, over 60% of the entire prescription drug market will be at risk.

So what can be done about it? There are several ways biopharma companies can mitigate this risk. And the most obvious one is developing new drugs. Theoretically, they can come up with the next blockbuster drug to fill that revenue gap that they're going to lose from their current blockbuster that's going off exclusivity.

There are a couple of ways they can do that:

They could develop new drugs completely organically internally.

They could acquire companies that they think have done a lot of the early R&D work for what could be a blockbuster drug (to derisk and shorten the R&D timeline)

They could do some R&D partnerships with other biopharma companies to develop what they think could be a blockbuster drug (to derisk and share the cost of bringing the new drug to market).

There are a couple other ways they can mitigate the impact using the existing drugs. They can come up with new formulations or new delivery methods. They could also take that existing drug and find a new indication for it. But still, the best way is to develop new drugs because that keeps the organizations innovating and staying ahead of the curve – and also addressing a wider array of patients’ needs – instead of relying on incrementalism on top of the existing blockbusters.

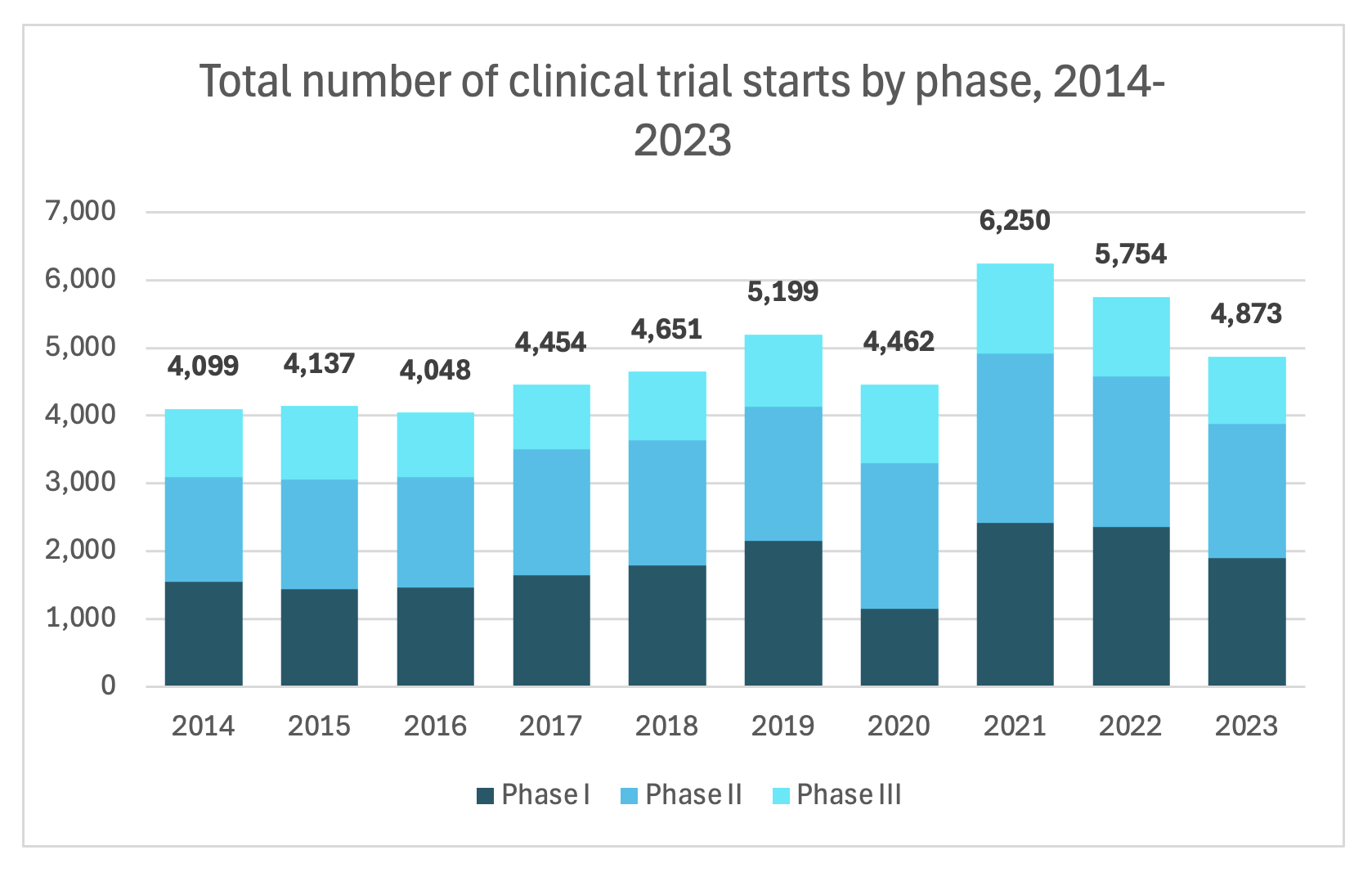

But the problem here is that pipelines are drying up. Below, you can see how the number of clinical trial starts is declining.

Source: Citeline Trialtrove, Jan 2024.

Notes: Phase II includes Phases I/II, II, Ila, IIb. Phase III includes Phase II/III and III. Terminated trials are included to track the activity still involved with their initiation, partial execution and termination. Trials were industry sponsored, interventional trials and device trials were excluded.

Report: Global Trends in R&D 2024: Activity, Productivity, and Enablers. IQVIA Institute for Human Data Science, February 2024.

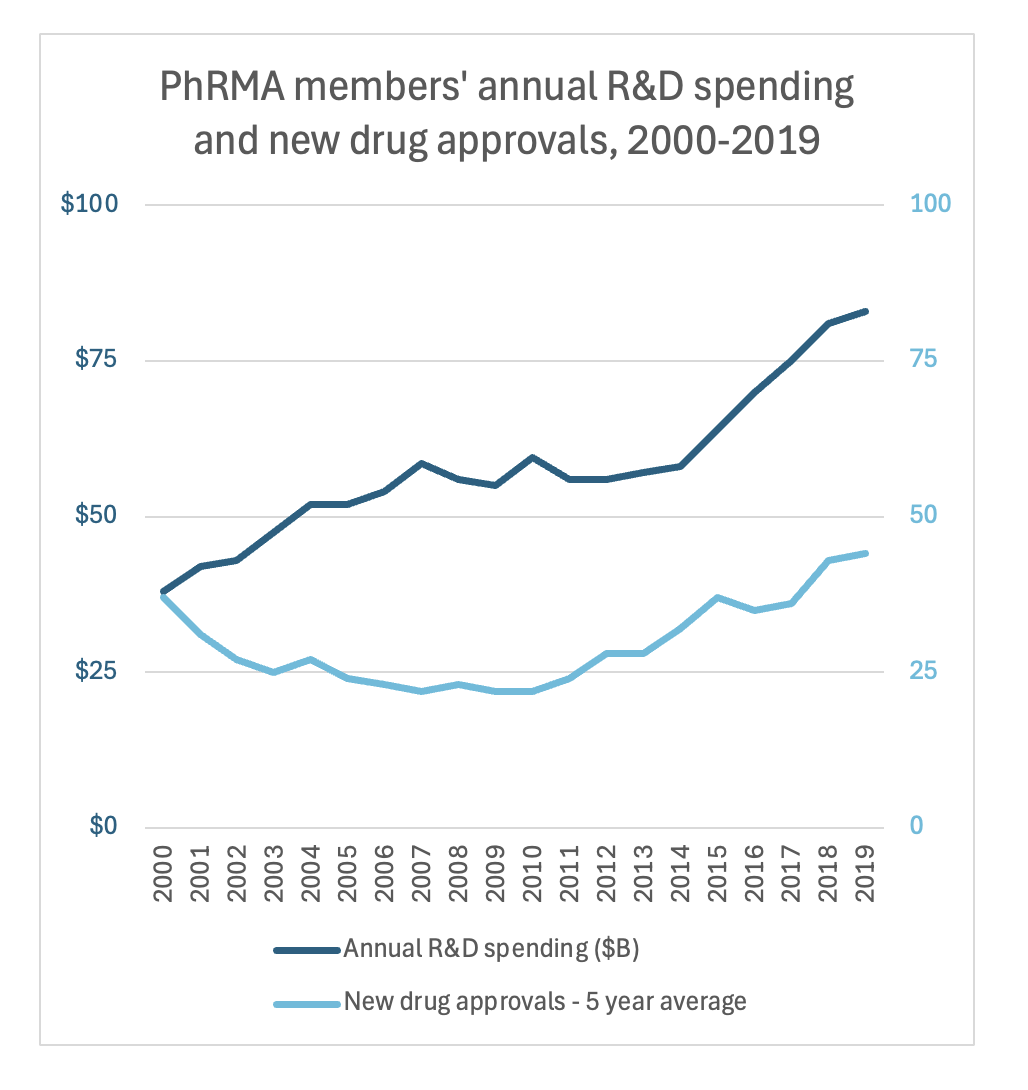

And, at the same time, R&D expenses continue to rise. According to IQVIA Institute, R&D expenditure by large pharma companies totaled a record $161B in 2023 (23.4% of sales), up almost +50% since 2018 ($108B, 19.6% of sales) and up +85% since 2014 ($87B, 17.2% of sales).

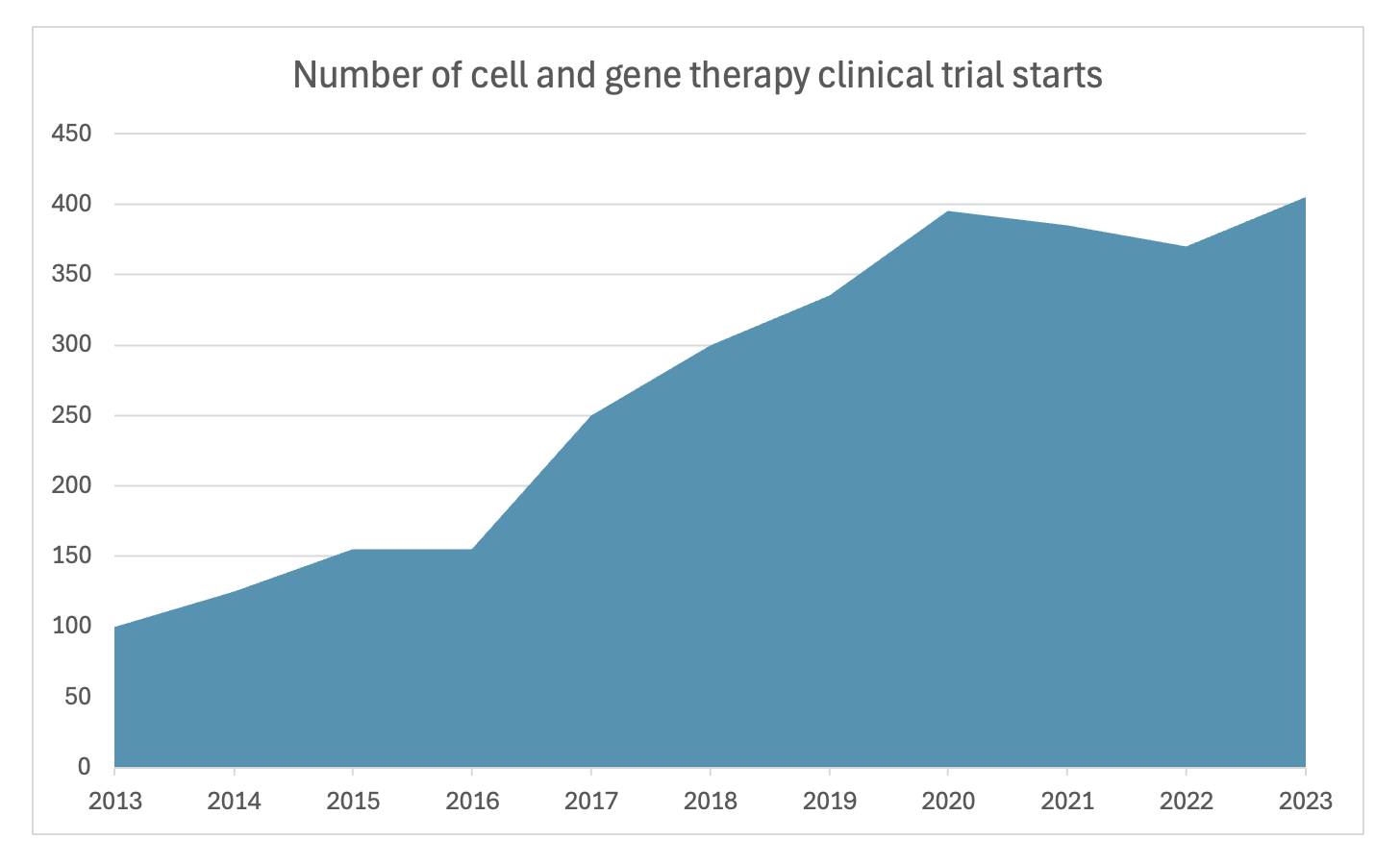

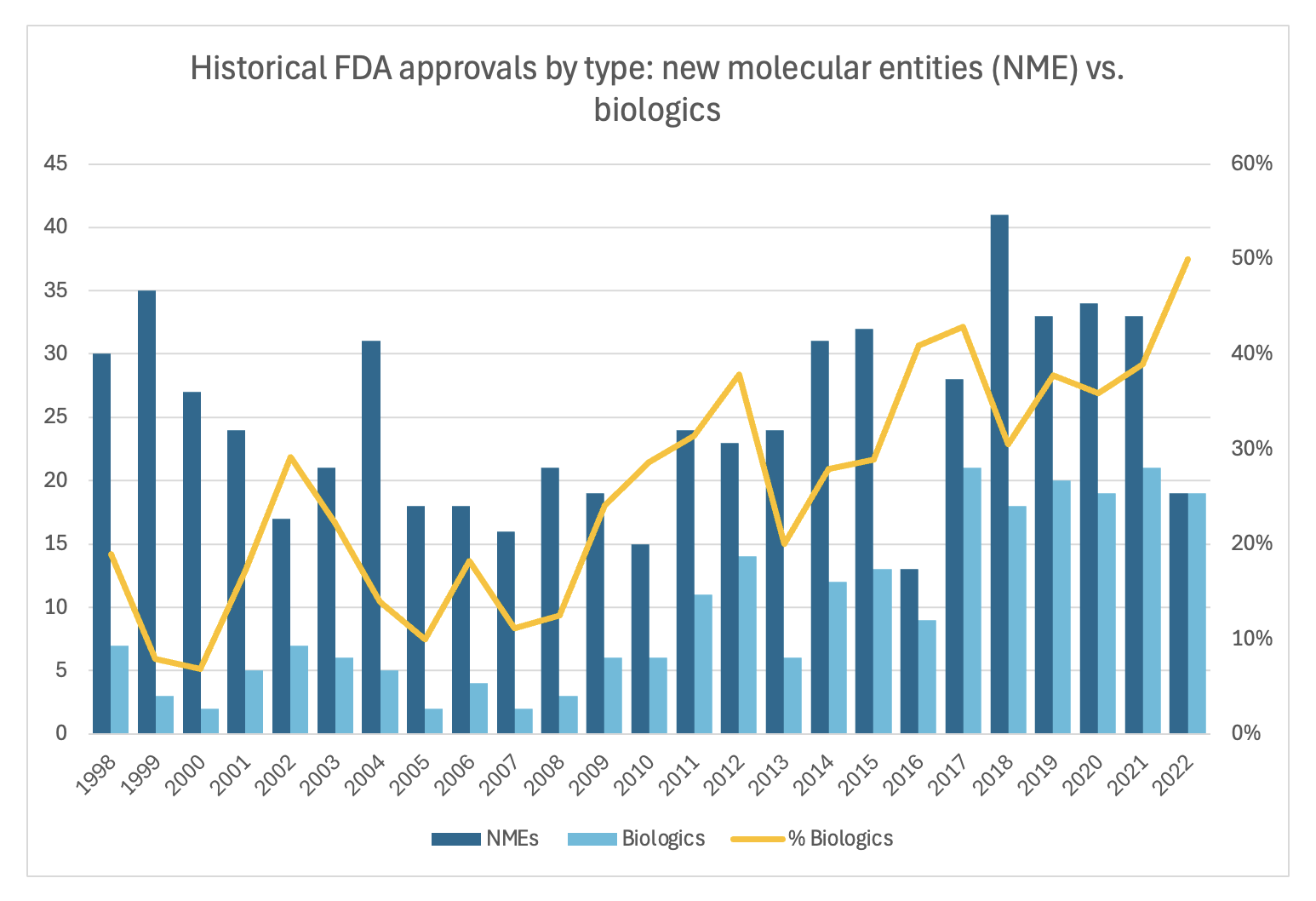

One reason is the rise of biologic development in the last couple decades. These are more complex and costly to develop than small molecules. As you can see below, cell and gene therapy (which are only a subset of biologics) clinical trials have been rising dramatically, more than 4x’ing in the last 10 years. And as a percent of FDA approvals each year, biologics are becoming more and more of the mix. In 2022 biologics made up 50% which of all FDA approvals, which is the highest in history.

Sources: IQVIA Institute, Nature Biotechnology

Another aspect impacting R&D right now is the Inflation Reduction Act (IRA). While the IRA aims to reduce drugs costs for consumers and the healthcare system, it introduces financial challenges for biopharmas that could lead to more cautious investment in R&D and could hamper pipelines further. Smaller biopharma are definitely going to get hit harder than large biopharma, but even those that are very well funded and have lots of cushion could start to reprioritize projects in the pipeline. For example, they could focus more on ones that have higher likelihood of commercial success, or ones that are going to be less impacted by the IRA. But as they prioritize those, they’re simultaneously shelving potentially more innovative projects. Another impact could be an increase in collaborative partnerships to share the financial burden of R&D.

So in short, two things are happening at once: the number of new drugs is declining and R&D expenses have been increasing. The net result is R&D productivity is experiencing a dramatic decline (the phenomenon is, funnily enough, referred to as Eroom’s Law (the reverse of Moore’s Law). This is one of the biggest “hair on fire” problems for all of biopharma.

Source: Brookings

Another major trend – and I alluded to this already a little bit with the IRA – is that because it's so much harder to come up with a new drug, a lot of companies are working together in more collaborative ways. Collaboration has long been an aspect of this industry, but the nature of it is changing. In the past, it used to be one-on-one relationships, very tightly defined success metrics and roles/responsibilities, and it was all around a singular asset and progressing that through the lifecycle. Now, it's much more open in structure, there are a lot more partners working together, and it's less about progressing a singular asset and more about scientific progression broadly.

A 2022 report from Drug Discovery Today shows how these big biopharma companies are at varying degrees on the spectrum, but most of them get about 50% of their pipeline projects from external sources in a network-based R&D structure. So they're working with a core set of external partners whether it be academic centers of excellence or innovation incubators or kind of smaller biopharma companies.

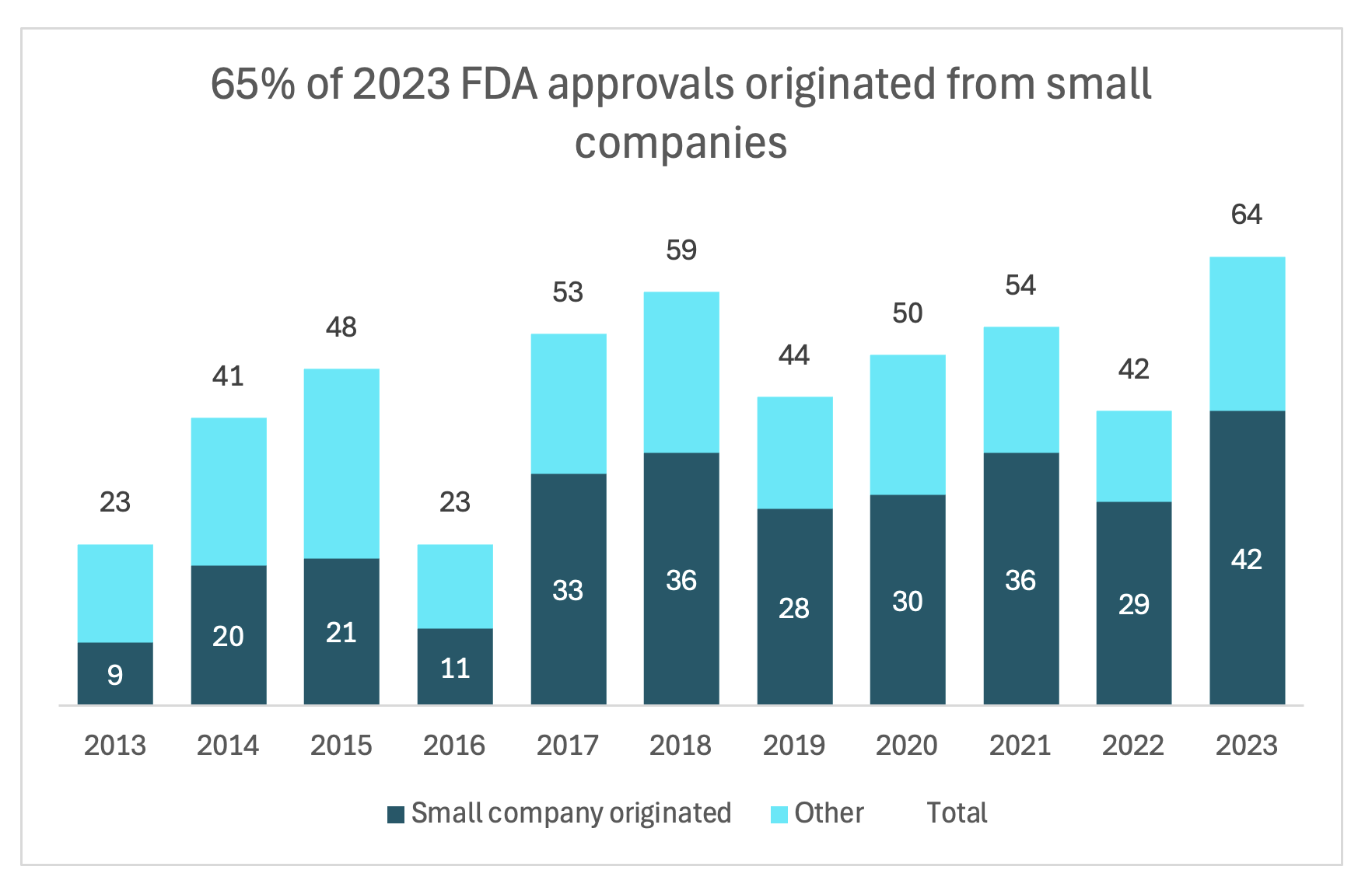

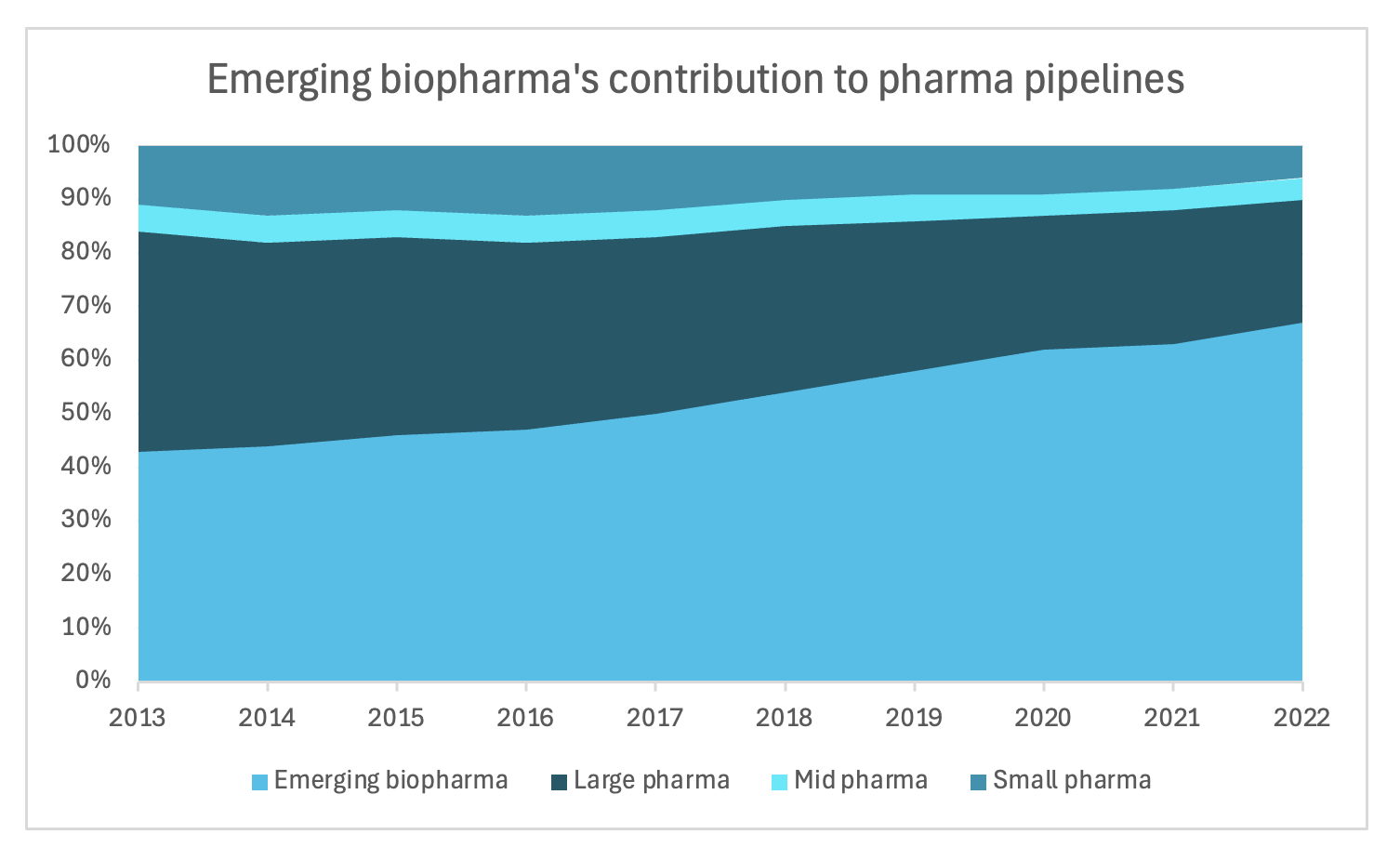

And to further emphasize that point, there's this growing reliance on small biopharma to innovate. As shown below, each year there’s a greater percent of FDA approvals originating from small companies. In 2023, 65% of all FDA approvals were originated by small companies, which is pretty extraordinary. And then on the right, you can see emerging biopharmas’ contribution to clinical trial pipelines. Between 2013 to 2022, their proportion of products in the clinical trial development phase have grown tremendously, going from 43% to 67%.

Sources: Bio, Piper Sandler

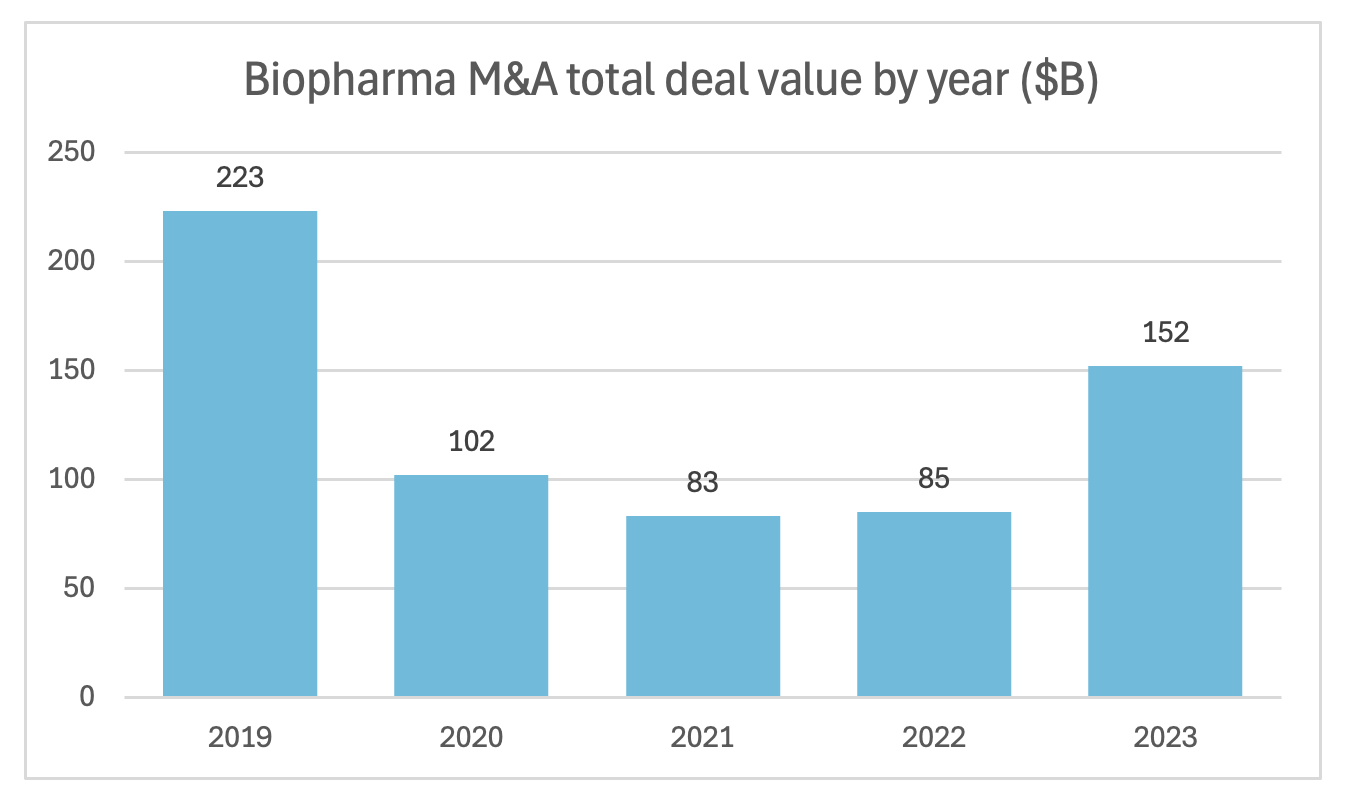

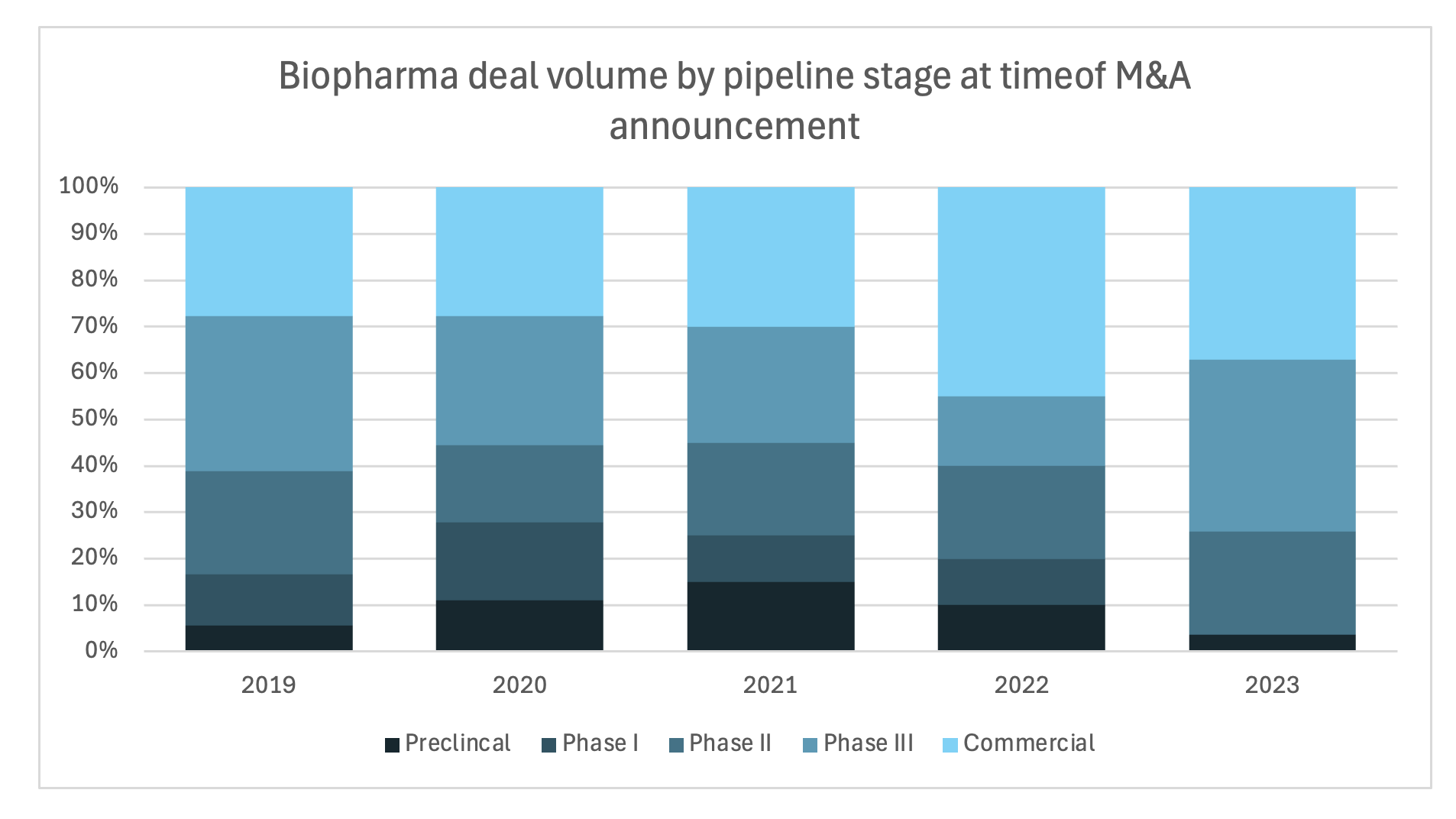

So going back to my earlier point, one way that large or even midsize biopharma companies facing the patent cliff can boost their pipeline is through M&A… and we’re definitely seeing that play out. M&A has been picking up, but it's skewing towards later stage assets, meaning smaller biopharma companies are having to bear that R&D burden a lot longer.

Source: IQVIA

And at the same time, the funding that they typically have relied upon is drying up as well. Private market funding activity has been declining and IPOs have fallen off a cliff as well. So these already pretty resource-constrained biopharmas are now even more resource constrained, and they’re increasingly having to outsource more and more of their clinical research and manufacturing activities to contract organizations.

All of these things combined – the open innovation ecosystem, the need to outsource more and more because of the resource constraints, and also the explosion of new datasets that people are using for R&D – has led to a very, very complicated web of data and workflows. And it's very, very fragmented even within organizations. But then when you add the complexity of the external stakeholders as well it becomes incredibly hard for companies to manage.

Software is likely to be the most crucial unlock here, and in particular, the potential AI-enabled software has for sorting through messy data and complicated workflows to produce something sensible. In our next article, we'll look at some of the opportunities that exist for improving the trend of declining productivity that results from a lot of this confusion and inefficiency.