By Laura Lenz, Ryan Zauk and Dave Wechsler

The growth of alternative asset classes has skyrocketed over the last decade. One by one, equities, bonds, FX, commodities, and more have slowly moved from handshakes, opaque pricing and the telephone to transparent data, open marketplaces, and straight-through-processing. As part of a large asset manager, and with OMERS’ investments including the likes of Carta, Crunchbase, and Affinity, we’ve had a front row seat to some of the opportunities in private markets data and the importance of a strong go-to-market strategy.

As a result, we believe we are in the midst of a sea change in capital markets infrastructure, creating previously unimaginable opportunities for select startups to come away as big winners and category-defining industry leaders in the coming decade.

The current state of capital markets

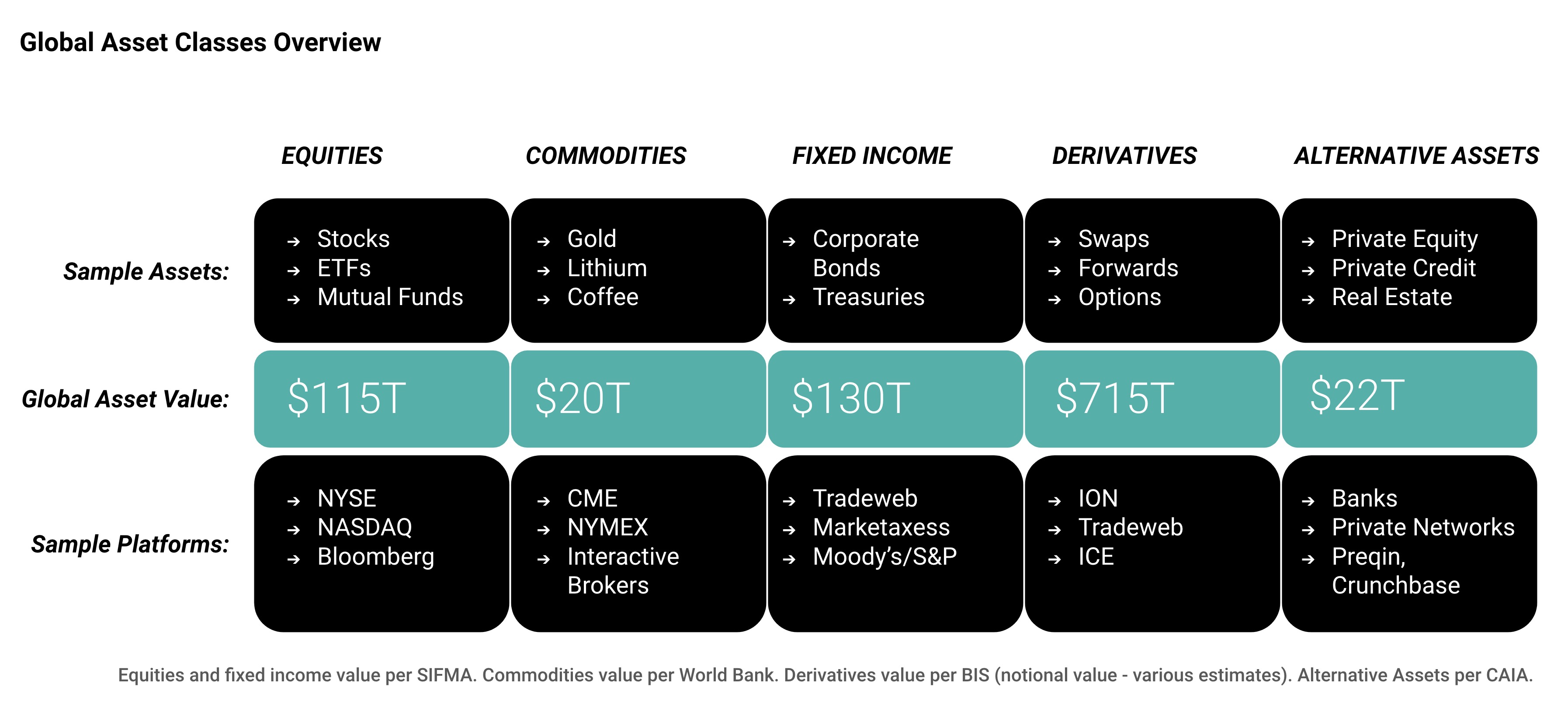

Capital Markets is defined as financial markets that bring buyers and sellers together to trade stocks, bonds, currencies, and other financial assets. Twenty-five years ago, the value of “other financial assets” was relatively small, estimated to be “just” over $1 trillion by the World Economic Forum. As a result, people generally excluded this asset class from the definition of Capital Markets (partially this might have been because banks weren’t well set up to service it, either). Today, after a decade of burgeoning growth, this alternative asset class represents approximately $22 trillion in value, which is hard to ignore. So, for the sake of clarity, when we talk about Capital Markets today, we are including alternative assets such as private credit, private equity, real estate, hedge funds, crypto – and even art.

The Capital Markets industry can be broken down as illustrated in the chart below. Each of these segments has its own characteristics, platforms, and levels of technology adoption. Equities, for instance, are largely traded electronically (85% per Sifma) with structured, real-time data and well-established market infrastructure. On the fixed income side, approximately 40% of corporate bonds are now priced and traded electronically.

In contrast to equities and corporate bonds, the infrastructure supporting alternative assets is nowhere near as well-established, making them a prime target for innovation as the class reaches scale.

The rise of alternative assets

Alternative assets might be experiencing explosive growth, but they lack the robust infrastructure and streamlined processes found in public markets. Some key characteristics of the alternatives space include:

1. Lack of market structure (exchanges & clearinghouses)

2. Unstructured, opaque, and bespoke data

3. Limited regulatory oversight and clarity

4. Peer-to-peer, complex, and closed-off deals

5. Manual trading processes

6. Lengthy settlement times (T+30-60 days)

7. Reliance on Excel and PDF workflows at scale (across front, middle, and back office)

These characteristics present a significant opportunity for fintech companies to create solutions that bring what we think of as "public equity-like behavior" to alternative assets.

Important to note here that opacity and lack of clarity is often considered a ‘feature, not a bug’ in finance as the tech adage goes. Many legacy players who have profited from this asset class regard its lack of transparency as an opportunity to accrue more value, or at least to engineer the majority of value flow in their direction vs. in the direction of those with whom they compete or do business with.

We anticipate there may be some reluctance from incumbents towards decreasing opacity around alternative asset data – but we believe such reluctance will bow to the need for more structure and transparency, a necessary and inevitable byproduct of asset class growth and maturity.

Why now? The perfect storm for innovation

There are several reasons we believe now is the time to look more seriously at startups in this category. At the most basic level, record transaction volumes are driving up costs and exposing the limitations of manual processes. Coupled with this growth, regulators are beginning to scrutinize alternative assets more closely, which will likely lead to increased reporting and transparency requirements.

A natural shift in demographics also means buyside and sellside decision makers are increasingly digitally native, and engineers make-up up a greater percentage of headcount than ever before. So, it makes sense that these institutions are increasingly open to non-traditional vendors and solutions, and we believe will become even more so over the medium-term.

And finally, not to be underestimated, there's a boom in founding teams with first-hand financial and technological experience building for various parts of the investment workflow (front, middle, and back office). These are teams that have first-hand experience of the problems and are creating impactful solutions for areas with massive need.

The vision: creating "public equity-like behavior" in alternative assets

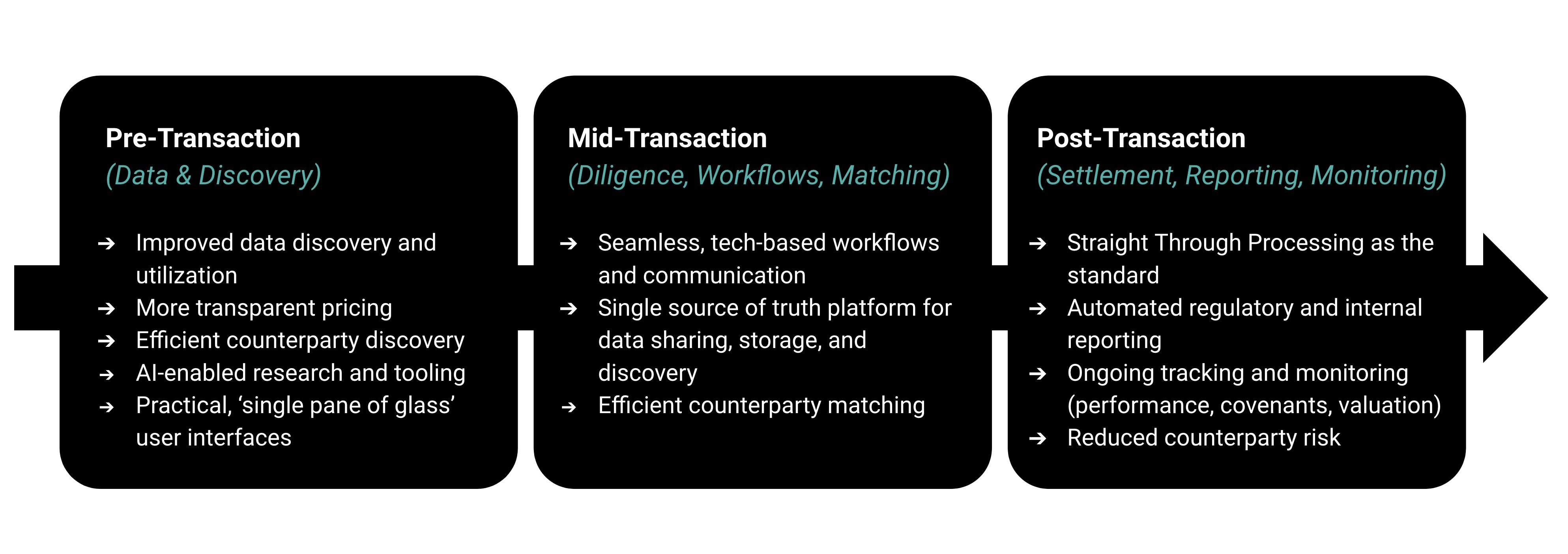

What do we mean by ‘public equity-like behavior?’ It’s basically the ability for financial institutions to trade alternative assets in the same way they trade public equities: with access to transparent data, open marketplaces, and straight-through-processing. This shift involves improvements across three key stages of the investment process:

Each of these areas includes a tremendous opportunity for fintech startups with the right team and expertise.

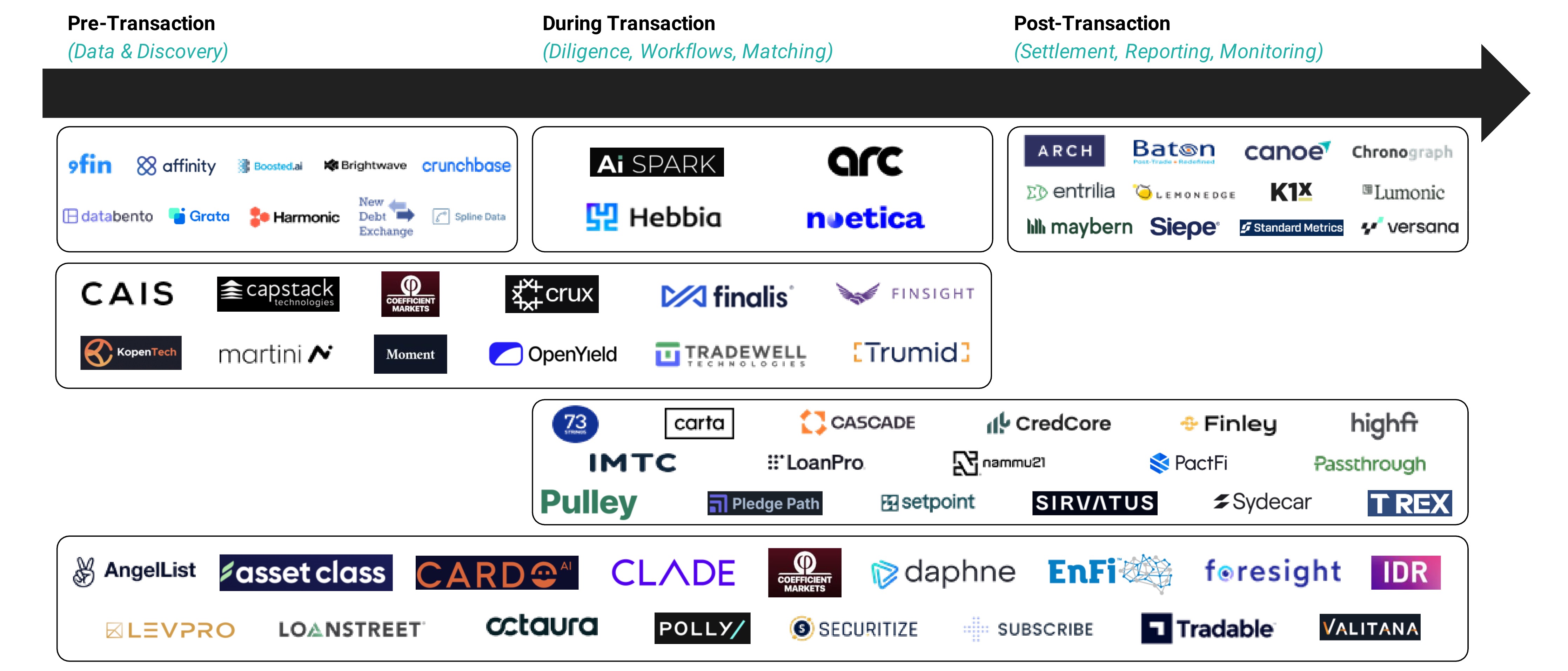

Today, there is a vast universe of companies building in this space, attacking 1, 2, or all 3 steps in a transaction. Some are laser-focused on one section of the transaction lifecycle, but most we’ve spoken with have their eye on two or more. Interestingly, nearly all companies have emphasized a clean, digestible, “single source of truth” data platform as their holy grail and enduring competitive advantage. Industry-moving acquisitions like Blackrock’s $3.2Bn acquisition of Preqin have come up frequently. Sector wise, these companies are building across public equities, fixed income, real estate, private equity, private credit, structured finance, and more to help bring them to a modern, tech-enabled future.

This market map is not exhaustive and will remain dynamic as companies expand across the stack.

We are open to investing in all boxes above – on one end, there are specialists building a focused, advanced product for a specific use case (like real estate fund accounting). This focus, especially in early stages, can help build a best-in-class product, focus GTM efforts, and establish credibility with what will largely be sophisticated buyers. On the other end, great businesses are often those that look to build large, ever-expanding platforms early that move up and down their industry value chain to expand contract value, addressable market, and deepen competitive moats.

Opportunities and challenges for fintech innovators

We see several advantages for companies addressing this space. The massive and growing total addressable markets is the most obvious. But more important is the opportunity for a technology provider to become a system of record for critical workflows and business units. Doing so will create strong network effects and, as a result, a significant moat. Businesses that get it right have the potential for exponential growth and ultimately to grow into businesses that become candidates for IPO.

But it isn’t an easy feat. FIs are famous for their long, painful, and bureaucratic sales cycles. And once a sale is made, implementations and integrations are often extremely complex and involve replacing entrenched legacy systems and prompting major behavior change – the industry is littered with startups who have died in the fight against Excel and PDF!

Couple those challenges with regulatory uncertainty, and the undertaking is significant. To succeed, it will take a team with the right mix of finance talent and the DNA / technical acumen of a tech startup.

Who will win?

We believe the opportunity is one worth backing. The key attributes we’re looking for in a business addressing this shift include some combination of the following:

1. Network effects: solutions that benefit exponentially as more users join the platform

2. Large addressable markets: ideally serving both buy-side and sell-side

3. Complementary to existing systems: products that augment rather than replace core systems, or are building a new System of Record where no incumbents exist

4. People augmentation: solutions that enhance human capabilities rather than jump to a fully automated future

5. Data enrichment: businesses that leverage and improve upon existing data

6. Clear value proposition: products that demonstrably improve revenue, efficiency, or reduce overhead

7. Traction: companies that have moved beyond the pilot stage and have a clear go-to-market strategy

8. Experienced founders and backing: teams with relevant industry experience and strong investor support

The more boxes a business can tick in these areas, the more likely we believe they are to succeed as venture-backable businesses.

A new era for capital markets technology

Massive growth in alternative assets, combined with increasing regulatory scrutiny and technological capabilities, are creating the perfect storm for innovation in capital markets technology.

The vision of bringing "public equity-like behavior" to alternative assets represents a significant opportunity to improve efficiency, transparency, and accessibility in a traditionally opaque and complex market. Success in this endeavor could unlock tremendous value, not just for individual companies, but for the financial system, as a whole, as better tech allows more participants to enter and transaction volume to grow.

For entrepreneurs, investors, and financial institutions, the message is clear: it’s time for bold innovations that can bridge the gap between the old and new.

If you’re building in this space, we’d love to hear from you and share our learnings from countless conversations across the ecosystem and with our partners at OMERS.